Popularity of Fundamental Analysis for Investors of Traders ?

Fundamental analysis remains a widely practiced and influential approach among investors and traders for evaluating securities and making informed investment decisions based on intrinsic value and economic factors. Here are the key reasons behind its enduring popularity: Conclusion Fundamental analysis continues to be highly regarded and widely practiced among investors and traders worldwide due to its emphasis on intrinsic value, long-term investment focus, and systematic evaluation of economic and financial data. While it requires diligent research and analysis, its enduring popularity underscores its effectiveness in guiding investment decisions aimed at achieving sustainable growth, income generation, and risk management in dynamic financial marke

Disadvantages of Fundamental Analysis for Investors of Traders?

Fundamental analysis, while widely used and effective in many aspects, also comes with several limitations and challenges that investors and traders should consider: Conclusion While fundamental analysis provides a robust framework for evaluating the intrinsic value of securities and making informed investment decisions, it is not without its drawbacks. Investors and traders should consider these limitations and complement fundamental analysis with other analytical tools, such as technical analysis, market sentiment analysis, and risk management strategies, to enhance their overall decision-making process and navigate the complexities of financial markets effectively.

Advantages of Fundamental Analysis for Investors of Traders ?

Fundamental analysis offers several advantages for investors and traders who use this method to evaluate securities and make investment decisions based on intrinsic value and economic factors. Here are the key benefits: Conclusion Fundamental analysis remains a cornerstone of investment strategies for investors and traders seeking to build wealth through the stock market and other financial instruments. By focusing on factors that influence a company’s financial performance and valuation, fundamental analysis enables informed decision-making aimed at maximizing returns and managing risks over the long term. While it requires diligent research and analysis, the advantages of fundamental analysis make it a valuable tool for investors looking to achieve sustainable growth and income from their investments. 3.5

What is Fundamental analysis for Investors or Traders ?

Fundamental analysis is a method used by investors and traders to evaluate the intrinsic value of a security by examining related economic, financial, and qualitative factors. Unlike technical analysis, which focuses on price and volume data, fundamental analysis delves into the underlying factors that could influence a security’s price over the long term. Here’s an overview of fundamental analysis and its application in investing and trading: Principles of Fundamental Analysis Application for Investors Application for Traders Criticisms of Fundamental Analysis Conclusion Fundamental analysis provides investors and traders with a comprehensive framework for evaluating securities based on economic, financial, and qualitative factors. By understanding a company’s financial health, industry dynamics, and broader economic trends, fundamental analysis enables informed decision-making aimed at maximizing investment returns and managing risks effectively over the long term. While it requires diligent research and analysis, fundamental analysis remains a fundamental tool for investors seeking to build wealth through the stock market and other financial markets. 3.5

Popularity of Technical Analysis for Investors of Traders ?

Technical analysis has gained significant popularity among investors and traders worldwide due to several factors that make it a preferred method for analyzing and trading financial markets: Conclusion The popularity of technical analysis among investors and traders continues to grow, driven by its accessibility, empirical evidence, quantitative approach, integration with algo trading, and educational resources. While it has its critics and limitations, technical analysis remains a cornerstone of many traders’ toolkits for analyzing markets, making trading decisions, and managing risk effectively.

Disadvantages of Technical Analysis for Investors and Traders

While technical analysis offers several benefits, it also has limitations and drawbacks that investors and traders should consider: Conclusion While technical analysis can be a valuable tool for making informed trading decisions and identifying short-term opportunities, it is essential for investors and traders to use it alongside other forms of analysis and to consider its limitations. Combining technical analysis with fundamental analysis and sound risk management practices can help mitigate the disadvantages and improve overall trading effectiveness.

Advantages of Technical Analysis for Investors of Traders ?

Technical analysis offers several advantages for investors and traders who utilize this method to make trading decisions. Here are the key benefits: 1. Identification of Trends and Patterns 2. Timing Entry and Exit Points 3. Risk Management 4. Confirmation of Market Sentiment 5. Applicability to Different Timeframes 6. Accessibility and Efficiency Conclusion Technical analysis provides investors and traders with a systematic approach to analyzing market trends, identifying patterns, and making informed trading decisions. By leveraging historical price and volume data, technical analysts can enhance their ability to time the market effectively, manage risk, and optimize profitability. While it is not without its limitations, the advantages of technical analysis make it a valuable tool for navigating the complexities of financial markets and achieving trading objectives.

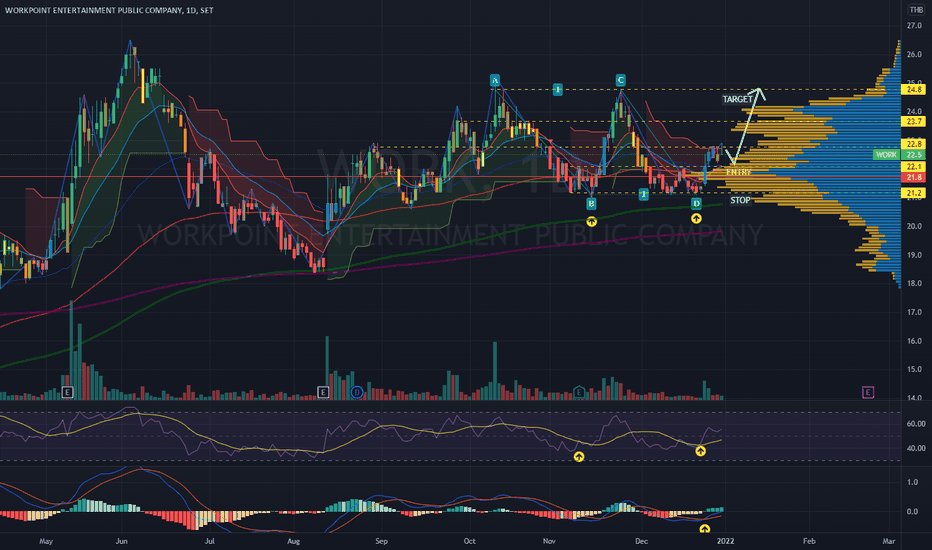

What is Technical analysis for Investors or Traders ?

Technical analysis is a method used by investors and traders to evaluate securities and forecast future price movements based on historical price and volume data. Unlike fundamental analysis, which focuses on financial statements and economic factors, technical analysis primarily examines past market data to identify patterns and trends that may indicate future price movements. Here’s an overview of technical analysis and its application in trading and investing: Principles of Technical Analysis Application for Investors Application for Traders Criticisms of Technical Analysis Conclusion Technical analysis is a valuable tool for both investors and traders to analyze securities and make informed decisions based on historical price and volume data. While it has its limitations and critics, many market participants find it useful for identifying trends, patterns, and potential trading opportunities. When used alongside other forms of analysis, such as fundamental analysis, technical analysis can provide a comprehensive view that helps investors and traders navigate the complexities of financial markets more effectively.

Algo trading for Index , Futures , Options trading?

Algorithmic trading, or algo trading, has expanded across various financial instruments, including indices, futures, and options. Each of these asset classes presents unique opportunities and challenges for algorithmic strategies. Here’s a detailed look at how algo trading is applied in these markets: Algo Trading for Index Trading Index trading involves trading financial instruments that track the performance of a market index, such as the Nifty 50 or the Sensex in India. Algo trading can enhance index trading through the following strategies: Algo Trading for Futures Trading Futures trading involves buying and selling contracts that obligate the purchase or sale of an asset at a future date at a predetermined price. Algo trading strategies for futures include: Algo Trading for Options Trading Options trading involves trading contracts that give the right, but not the obligation, to buy or sell an asset at a specified price before a certain date. Algo trading strategies for options include: Conclusion Algo trading has become an integral part of trading indices, futures, and options in India. For index trading, algorithms can efficiently exploit arbitrage opportunities, predict index rebalancing effects, and minimize tracking errors. In futures trading, high-frequency trading, trend following, and mean reversion strategies are prevalent. Options trading benefits from volatility arbitrage, delta-neutral strategies, and sophisticated options spreads. By leveraging these advanced algorithmic strategies, traders and investors can enhance their trading efficiency, reduce risks, and potentially increase their returns across these diverse financial instruments.

Popular Algo trading in India ?

Algorithmic trading, or algo trading, has become increasingly popular in India, driven by advancements in technology and the growing sophistication of financial markets. Both retail traders and institutional investors use various algo trading strategies to enhance their trading efficiency and effectiveness. Here are some of the most popular algo trading strategies in India: 1. High-Frequency Trading (HFT) High-Frequency Trading (HFT) involves executing a large number of orders at extremely high speeds. HFT algorithms capitalize on tiny price discrepancies that exist for just fractions of a second. 2. Trend Following Trend Following strategies involve identifying and following market trends. Algorithms are programmed to detect trends and execute trades accordingly, aiming to profit from the continued movement of prices in a particular direction. 3. Arbitrage Arbitrage strategies seek to exploit price differences of the same asset in different markets or forms. 4. Market Making Market Making algorithms provide liquidity to the markets by simultaneously placing buy and sell orders. The goal is to profit from the bid-ask spread. 5. Mean Reversion Mean Reversion strategies are based on the idea that prices will revert to their historical mean or average level. When prices deviate significantly from their average, the algorithm initiates trades to profit from the expected return to the mean. 6. Statistical Arbitrage Statistical Arbitrage strategies involve using statistical models to identify and exploit pricing inefficiencies between related financial instruments. 7. Execution-Based Strategies Execution-Based Strategies focus on optimizing the execution of large orders to minimize market impact and achieve the best possible price. 8. Sentiment Analysis Sentiment Analysis strategies involve analyzing market sentiment, often through news articles, social media, and other public sources, to make trading decisions. Conclusion Algo trading in India encompasses a wide range of strategies, each with its unique approach to capturing market opportunities. High-frequency trading, trend following, arbitrage, market making, mean reversion, statistical arbitrage, execution-based strategies, and sentiment analysis are some of the most popular methods employed by traders and investors. With advancements in technology and increasing market sophistication, the use of these strategies continues to grow, offering diverse opportunities for both retail and institutional participants in the Indian financial markets.